What Is The Minimum Payment On A Credit Card With 5000 Balance

adminse

Apr 05, 2025 · 7 min read

Table of Contents

What's the magic number? Unveiling the minimum payment mystery on a $5000 credit card balance.

Understanding your minimum payment is crucial for responsible credit card management, and avoiding crippling debt.

Editor’s Note: This article on minimum credit card payments was published today, [Date]. We’ve compiled up-to-date information to help you understand how minimum payments work and their long-term implications for a $5000 balance.

Why Minimum Payments Matter: Relevance, Practical Applications, and Financial Health

Ignoring the fine print on your credit card statement can lead to significant financial setbacks. Knowing your minimum payment isn’t just about avoiding late fees; it’s about understanding the true cost of carrying a balance and developing a responsible debt management strategy. A $5000 balance, while substantial, is manageable with a clear plan, but that plan begins with understanding the minimum payment and its implications. This knowledge is vital for budgeting, avoiding high interest charges, and improving your credit score.

Overview: What This Article Covers

This article dives deep into the world of minimum credit card payments. We'll explore how minimum payments are calculated, the significant drawbacks of only making minimum payments, strategies for paying down your balance more efficiently, and resources available to help manage credit card debt. You'll gain a clear understanding of how minimum payments affect your finances and learn actionable steps to take control of your debt.

The Research and Effort Behind the Insights

This article is the product of extensive research, drawing on information from consumer finance websites, credit card company websites, and financial literacy resources. We've analyzed various credit card agreements and payment calculations to provide accurate and up-to-date information. The aim is to provide readers with a comprehensive understanding of minimum payments and their impact on a $5000 balance.

Key Takeaways: Summarize the Most Essential Insights

- Minimum Payment Calculation: Understanding how your credit card company calculates your minimum payment is the first step.

- High Interest Costs: The primary drawback of only paying the minimum is the accumulation of substantial interest charges.

- Debt Snowball Effect: Minimum payments can trap you in a cycle of debt, making it difficult to reduce your balance significantly.

- Strategic Payment Approaches: Explore methods to accelerate debt repayment, such as the debt avalanche or debt snowball method.

- Credit Score Impact: High credit utilization (the percentage of your available credit you're using) negatively impacts your credit score.

Smooth Transition to the Core Discussion

Now that we understand the significance of understanding minimum payments, let's delve into the specifics of calculating and managing them for a $5000 balance.

Exploring the Key Aspects of Minimum Payments on a $5000 Balance

1. Definition and Core Concepts:

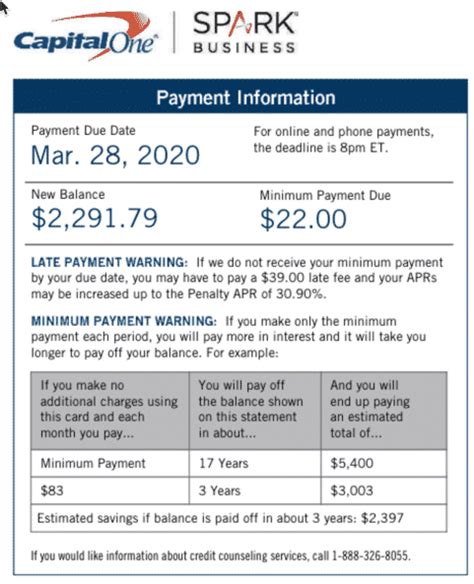

The minimum payment is the smallest amount a credit card issuer allows you to pay each month without incurring a late payment fee. It's usually a percentage of your outstanding balance (often 1-3%), plus any accrued interest and fees. A fixed minimum payment amount might also be specified, typically around $25-$35, irrespective of your balance. This minimum payment doesn't include new purchases made during the billing cycle.

2. How Minimum Payments Are Calculated:

Credit card companies use varying formulas to determine the minimum payment. While there's no universal standard, a common approach involves calculating a percentage of your outstanding balance (e.g., 1% or 2%) and adding any accrued interest. This means your minimum payment will fluctuate depending on your balance and interest rate. For a $5000 balance, depending on the APR (Annual Percentage Rate) and the specific calculation method, the minimum could range from $25 to $150, or even more.

3. Applications Across Industries:

The concept of minimum payments is consistent across most credit card issuers, though the specific calculation methods might vary slightly. Many store credit cards or retail cards may have higher minimum payments or different payment structures. Understanding your specific card agreement is essential.

4. Challenges and Solutions:

The primary challenge associated with minimum payments is the slow repayment pace. The high interest charges, coupled with minimal principal reduction, create a debt snowball effect. To break this cycle, you need a more aggressive repayment strategy—paying more than the minimum each month. Solutions include budgeting techniques, debt consolidation, and seeking professional financial guidance.

5. Impact on Innovation:

The financial technology (fintech) industry is developing innovative tools and apps to help individuals manage credit card debt more effectively. These tools often offer budgeting assistance, debt tracking, and personalized repayment plans.

Closing Insights: Summarizing the Core Discussion

Minimum payments are a double-edged sword. While convenient, they often lead to significant long-term costs due to compounding interest. On a $5000 balance, relying solely on minimum payments can extend your repayment period significantly, costing thousands of dollars in extra interest charges.

Exploring the Connection Between Interest Rates and Minimum Payments

The relationship between interest rates and minimum payments is crucial. A higher interest rate means more of your minimum payment goes towards interest, leaving less to reduce the principal balance. For a $5000 balance with a high APR (e.g., 20%), a large portion of each minimum payment will cover interest, making debt repayment slower. This demonstrates the importance of understanding your APR and actively seeking ways to lower it, such as balance transfers to a lower-interest card.

Key Factors to Consider:

- Roles and Real-World Examples: A 20% APR on a $5000 balance significantly increases the minimum payment and slows down principal reduction, costing you more in the long run.

- Risks and Mitigations: The biggest risk is long-term debt accumulation. Mitigation involves paying more than the minimum, exploring debt consolidation, or seeking financial counseling.

- Impact and Implications: High interest rates prolong debt repayment, harming your credit score and overall financial health.

Conclusion: Reinforcing the Connection

The connection between high interest rates and minimum payments on a significant balance like $5000 is undeniable. Understanding this relationship is paramount to developing an effective debt repayment strategy. Failing to address high interest costs can lead to years of payments without significant principal reduction.

Further Analysis: Examining Interest Calculation in Greater Detail

Credit card interest is typically calculated daily on your outstanding balance. This means interest accrues even on the smallest outstanding amount. The daily interest is added to your balance, and this new balance becomes the basis for the next day's interest calculation. This process of compounding interest is what makes high interest rates so detrimental. The longer you carry a balance, the more interest you'll accumulate. Many credit card companies use the Average Daily Balance method (ADB) which calculates the average daily balance and then applies the interest rate to that average amount.

FAQ Section: Answering Common Questions About Minimum Payments

Q: What is the typical range for minimum payments on a $5000 credit card balance?

A: The range varies significantly depending on the interest rate and the credit card issuer's calculation method. It could range from $25 to $150 or more.

Q: Why is only making minimum payments a bad idea?

A: It prolongs repayment, significantly increasing the total interest paid and keeping you in debt much longer.

Q: What happens if I don't make the minimum payment?

A: You'll incur late fees, and your credit score will be negatively impacted. Your account may even be sent to collections.

Q: What strategies can I use to pay off my credit card debt faster?

A: Consider debt snowball (smallest debt first) or debt avalanche (highest interest rate first) methods. Budgeting and increased income are also crucial.

Q: Where can I find help managing my credit card debt?

A: Non-profit credit counseling agencies offer free or low-cost services.

Practical Tips: Maximizing the Benefits of Responsible Credit Card Management

- Understand Your Statement: Carefully review your statement to understand the minimum payment amount, interest rate, and fees.

- Budgeting: Create a realistic budget to identify extra funds you can allocate towards debt repayment.

- Debt Repayment Strategies: Research and implement the debt snowball or debt avalanche method.

- Negotiate with Your Credit Card Company: Inquire about lower interest rates or payment plans.

- Seek Professional Help: Contact a non-profit credit counseling agency if you're struggling to manage your debt.

Final Conclusion: Wrapping Up with Lasting Insights

A $5000 credit card balance requires a proactive and strategic approach to repayment. Understanding minimum payments is the first step, but relying solely on them can trap you in a cycle of debt. By implementing a comprehensive debt repayment strategy, including budgeting, strategic payment approaches, and potentially seeking professional help, you can regain control of your finances and achieve financial freedom. Remember, proactive management is key to avoiding the long-term financial burdens of high-interest debt.

Latest Posts

Latest Posts

-

What Does A 790 Credit Score Mean

Apr 07, 2025

-

What Can I Get With A 790 Credit Score

Apr 07, 2025

-

How Common Is A 790 Credit Score

Apr 07, 2025

-

How To Qualify For Navy Federal Credit Union

Apr 07, 2025

-

How To Increase Navy Federal Credit Card Limit

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about What Is The Minimum Payment On A Credit Card With 5000 Balance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.