What Is The Minimum Payment On A $3000 Credit Card Chase

adminse

Apr 05, 2025 · 7 min read

Table of Contents

Unlocking the Mystery: What's the Minimum Payment on a $3000 Chase Credit Card?

What if your understanding of credit card minimum payments could save you thousands of dollars in interest? Mastering this crucial aspect of credit card management is key to responsible borrowing and financial well-being.

Editor’s Note: This article provides up-to-date information on calculating minimum payments for Chase credit cards, offering practical strategies for managing debt effectively. Remember, specific minimum payment amounts are determined by your individual credit card agreement.

Why Understanding Minimum Payments Matters:

Understanding your minimum credit card payment isn't just about avoiding late fees; it's a cornerstone of responsible credit card management. Failing to understand the nuances of minimum payments can lead to a cycle of accumulating debt, increased interest charges, and damage to your credit score. This knowledge is crucial for both budgeting and long-term financial health. This article will delve into the factors influencing your Chase $3000 credit card minimum payment and provide strategies for effective debt management.

Overview: What This Article Covers

This comprehensive guide explores the calculation of minimum payments on Chase credit cards, particularly concerning a $3000 balance. We will examine the factors affecting minimum payment amounts, the implications of only paying the minimum, strategies for paying down debt more effectively, and answer frequently asked questions. Readers will gain valuable insights into responsible credit card usage and actionable steps to improve their financial situation.

The Research and Effort Behind the Insights:

The information presented here is based on a thorough review of Chase credit card agreements, financial industry best practices, and analysis of relevant consumer finance resources. We've consulted official Chase documentation, industry reports, and expert opinions to ensure accuracy and provide readers with reliable and actionable information.

Key Takeaways:

- Minimum Payment Calculation: A detailed explanation of how Chase calculates minimum payments.

- Factors Affecting Minimum Payments: An in-depth look at the variables involved.

- The High Cost of Minimum Payments: Understanding the long-term implications of only paying the minimum.

- Strategies for Faster Debt Repayment: Actionable steps to get out of debt quicker.

- Avoiding Late Fees and Penalties: Practical tips for on-time payments.

Smooth Transition to the Core Discussion:

While there's no single fixed minimum payment for a $3000 Chase credit card, understanding the underlying principles and variables is vital. Let’s explore the key factors that determine your minimum payment.

Exploring the Key Aspects of Minimum Payments on a Chase Credit Card

1. Definition and Core Concepts:

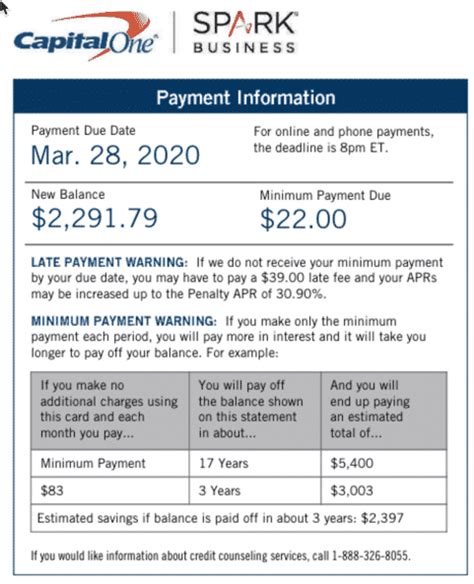

The minimum payment on a credit card is the smallest amount you can pay each month without incurring a late payment fee. This amount is typically a percentage of your balance (often 1-3%), plus any accrued interest and fees. Chase, like other credit card issuers, specifies this minimum payment on your monthly statement. Crucially, this minimum payment does not include the full balance; only a fraction.

2. Applications Across Industries:

The concept of minimum payments is consistent across most credit card issuers, although the specific percentage and calculation methods might vary slightly. Understanding this consistency helps you manage multiple credit cards more efficiently.

3. Challenges and Solutions:

The primary challenge associated with only paying the minimum is the accumulation of interest charges. Over time, the interest compounds, making the debt more difficult to repay. The solution is to pay more than the minimum whenever possible to reduce the principal balance and shorten the repayment period.

4. Impact on Innovation:

Credit card companies constantly refine their payment processing systems and financial models. While minimum payment calculations haven't changed drastically, improved online tools and apps offer clearer visibility into your balance and payment options.

Closing Insights: Summarizing the Core Discussion:

Understanding your minimum payment on a Chase credit card (or any credit card) is paramount. While it offers a baseline for avoiding late fees, relying solely on minimum payments traps you in a cycle of debt. Strategic repayment, beyond the minimum, is crucial for long-term financial well-being.

Exploring the Connection Between Interest Rates and Minimum Payments

The interest rate on your Chase credit card significantly impacts your minimum payment. A higher interest rate means a larger portion of your minimum payment goes towards interest, leaving less to reduce the principal balance. Let’s explore this connection:

Key Factors to Consider:

Roles and Real-World Examples:

Imagine two scenarios: one with a 15% APR and another with a 25% APR, both with a $3000 balance. The higher APR card will demand a larger minimum payment (often a larger percentage of the balance), primarily due to the higher interest accrual.

Risks and Mitigations:

The risk of a high APR is slow debt repayment, leading to extended debt and a substantial increase in the total interest paid over time. Mitigation involves actively seeking lower interest rate options (balance transfers, debt consolidation), paying more than the minimum, and improving your credit score to qualify for better rates.

Impact and Implications:

The impact of interest rates on minimum payments extends beyond your monthly budget. It influences your overall financial health, affecting your credit score, savings capacity, and future borrowing opportunities.

Conclusion: Reinforcing the Connection

The undeniable link between interest rates and minimum payments necessitates careful attention. High APRs necessitate strategic payment plans to minimize the long-term financial burden. Regularly reviewing your credit card statement for interest rate details and exploring ways to reduce it is vital.

Further Analysis: Examining APRs in Greater Detail

Annual Percentage Rates (APRs) are variable and depend on factors like your creditworthiness, the type of card, and market conditions. Understanding how these factors influence your APR will help you negotiate better rates. Credit bureaus like Experian, Equifax, and TransUnion play a role in determining your creditworthiness, which is a crucial factor in securing a lower APR.

FAQ Section: Answering Common Questions About Chase Credit Card Minimum Payments:

Q: What is the typical minimum payment percentage for Chase credit cards?

A: While Chase doesn't publicly state a fixed percentage, it's generally between 1% and 3% of your outstanding balance, plus interest and fees. This is clearly outlined on your monthly statement.

Q: Does Chase charge late fees?

A: Yes, Chase typically charges late fees if your payment isn't received by the due date. The specific amount of the late fee is mentioned in your cardholder agreement.

Q: How is the interest calculated on my Chase credit card?

A: Chase calculates interest daily on your outstanding balance. The daily interest is then added to your total balance, creating compounding interest.

Q: Can I change my minimum payment amount?

A: No, you cannot change the minimum payment amount set by Chase. However, you can always pay more than the minimum, which is highly recommended.

Q: What happens if I only pay the minimum payment for several months?

A: If you only pay the minimum, your debt will take longer to repay, and you'll end up paying significantly more in interest over time.

Practical Tips: Maximizing the Benefits of Understanding Minimum Payments:

- Read Your Statement Carefully: Pay close attention to your minimum payment amount, due date, and interest charges.

- Budget Effectively: Allocate funds specifically for your credit card payments to avoid late payments.

- Pay More Than the Minimum: Even small extra payments significantly reduce the principal and interest paid over time.

- Explore Debt Consolidation: Consider transferring your balance to a lower interest rate card to save money.

- Monitor Your Credit Score: A better credit score often qualifies you for lower interest rates.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding the minimum payment on your $3000 Chase credit card is just the first step toward responsible credit card management. While the minimum payment prevents late fees, focusing solely on it will lead to prolonged debt and substantial interest payments. By strategically paying more than the minimum, carefully monitoring your interest rate, and employing responsible budgeting practices, you can gain control of your finances and build a healthier financial future. Remember, informed decisions are the key to unlocking financial freedom.

Latest Posts

Latest Posts

-

What Percentage Should You Keep Your Credit Utilization Under

Apr 07, 2025

-

What Percentage Should I Keep My Credit Utilization

Apr 07, 2025

-

How Good Is 790 Credit Rating

Apr 07, 2025

-

What Does A 790 Credit Score Mean

Apr 07, 2025

-

What Can I Get With A 790 Credit Score

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about What Is The Minimum Payment On A $3000 Credit Card Chase . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.