What Does The Minimum Payment Amount On A Credit Card Statement Indicate

adminse

Apr 05, 2025 · 7 min read

Table of Contents

Decoding the Mystery: What Your Credit Card Minimum Payment Actually Means

What if ignoring that seemingly insignificant minimum payment on your credit card statement could lead to a financial landslide? Understanding this small number is crucial for responsible credit card management and long-term financial health.

Editor's Note: This article on credit card minimum payments was published today and provides up-to-date information on this critical aspect of personal finance. Understanding your minimum payment is key to avoiding costly interest charges and building good credit.

Why Your Minimum Payment Matters: More Than Just a Suggestion

The minimum payment amount displayed on your credit card statement isn't a recommendation; it's a legally mandated calculation. While seemingly inconsequential, consistently paying only the minimum can lead to significant long-term financial burdens, impacting your credit score and overall financial well-being. Understanding its calculation and implications is crucial for responsible credit use. This article will explore the intricacies of minimum payments, their impact on your finances, and strategies for effective credit card management. We'll delve into how interest accrues, the effect on your credit score, and ultimately, how to avoid the pitfalls of minimum payment traps.

Overview: What This Article Covers

This article provides a comprehensive exploration of credit card minimum payments. We'll cover the calculation behind the minimum payment, the devastating effects of only paying the minimum, the importance of paying more, how minimum payments impact your credit score, and finally, practical strategies for responsible credit card usage. We will also address frequently asked questions and offer actionable advice.

The Research and Effort Behind the Insights

This article draws upon extensive research from reputable financial institutions, consumer protection agencies, and scholarly articles on personal finance. Data points used to illustrate the impact of minimum payments are based on commonly accepted interest rates and payment structures. The information provided is intended to be informative and educational, empowering readers to make informed financial decisions.

Key Takeaways:

- Understanding the Calculation: We'll dissect how the minimum payment is determined.

- The High Cost of Minimum Payments: We'll reveal the true cost of only paying the minimum.

- Impact on Credit Scores: We'll explore how minimum payments affect your creditworthiness.

- Strategies for Responsible Credit Card Use: We'll offer practical tips for avoiding debt traps.

- Addressing Common Questions: We'll answer your frequently asked questions.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding your minimum payment, let's dive into the specifics of its calculation and the long-term financial implications involved.

Exploring the Key Aspects of Minimum Payments

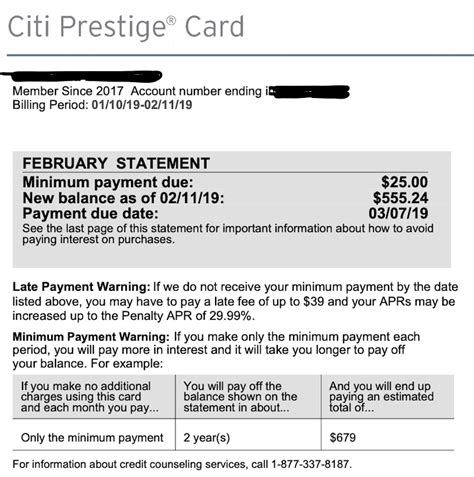

1. Definition and Core Concepts: The minimum payment is the smallest amount a credit card issuer requires you to pay each month to avoid late payment fees and remain in good standing. It usually comprises a portion of your outstanding balance and, critically, a portion (often a significant portion) of the accrued interest. The percentage of the principal balance included in the minimum payment can vary depending on the credit card issuer and your account's terms.

2. Applications Across Industries: While the concept remains consistent across credit card issuers, the specific calculation methods and minimum payment amounts can differ. Some issuers may use a fixed minimum payment amount, while others calculate it as a percentage of the outstanding balance (usually between 1% and 3%), plus any accrued interest.

3. Challenges and Solutions: The primary challenge associated with minimum payments is the slow repayment of the principal balance due to the substantial interest component. The solution is simple yet often ignored: pay more than the minimum each month.

4. Impact on Innovation: While not directly driving innovation in the financial technology sector, the understanding of minimum payment calculations and their implications has led to the development of numerous budgeting and debt repayment tools and apps designed to help consumers manage their credit card debt effectively.

Closing Insights: Summarizing the Core Discussion

Understanding your minimum payment is not merely about avoiding late fees; it's a cornerstone of responsible credit card management. Consistently paying only the minimum can trap you in a cycle of debt, delaying repayment and leading to the accumulation of significant interest charges. The seemingly small minimum payment is a gateway to either financial stability or a debt spiral.

Exploring the Connection Between Interest Rates and Minimum Payments

The relationship between interest rates and minimum payments is profoundly significant. High interest rates make it exponentially harder to pay down your debt, even if you consistently pay more than the minimum. This is because a larger portion of your payment goes towards interest, leaving less to reduce your principal balance. This vicious cycle is what makes paying only the minimum so damaging.

Key Factors to Consider:

- Roles and Real-World Examples: Let's say you have a $5,000 balance with a 18% APR. Even if you pay more than the minimum payment, a considerable portion might still go towards interest, potentially delaying your debt-free date by years.

- Risks and Mitigations: The biggest risk is prolonged debt accumulation, potentially leading to financial stress and damage to your credit score. Mitigation involves paying significantly more than the minimum and exploring options like balance transfers or debt consolidation to potentially lower your interest rate.

- Impact and Implications: Prolonged reliance on minimum payments negatively impacts your financial future, potentially hindering major purchases like a home or car. It also impacts your credit score, affecting your ability to secure loans with favorable terms in the future.

Conclusion: Reinforcing the Connection

The connection between interest rates and minimum payments is undeniably crucial. High interest rates make paying off debt much slower and more expensive, reinforcing the importance of paying more than the minimum whenever possible. Understanding this relationship is fundamental to responsible credit card use and financial planning.

Further Analysis: Examining Interest Accrual in Greater Detail

Interest accrues daily on your outstanding credit card balance. The minimum payment often barely covers the interest charges, leaving your principal balance largely untouched. This means that your debt remains stagnant, or even increases, despite regular payments. The longer you rely on minimum payments, the more interest you accumulate, leading to a snowball effect that can quickly overwhelm you. This daily compounding of interest is a key factor driving the rapid growth of credit card debt for those consistently paying only the minimum.

FAQ Section: Answering Common Questions About Minimum Payments

Q: What happens if I only pay the minimum payment?

A: While you avoid late fees, you'll pay significantly more in interest over time, extending the life of your debt and potentially increasing your overall cost.

Q: How is the minimum payment calculated?

A: It's usually a combination of a percentage of your outstanding balance (often between 1% and 3%) plus the accrued interest.

Q: Can I negotiate a lower minimum payment?

A: While generally not possible, you can explore options like debt consolidation or balance transfers to lower your interest rate and potentially reduce your monthly payments.

Q: What is the impact of consistently paying only the minimum on my credit score?

A: While not directly impacting your credit score, it indicates poor financial management, indirectly lowering your score over time by increasing your credit utilization ratio and potentially leading to late payments.

Practical Tips: Maximizing the Benefits of Paying More Than the Minimum

-

Budgeting: Create a realistic budget that allows you to allocate more money towards your credit card debt repayment each month.

-

Debt Snowball or Avalanche: Explore debt repayment methods like the snowball (paying the smallest debt first) or avalanche (paying the highest interest debt first) methods to accelerate debt reduction.

-

Extra Payments: Make extra payments whenever possible, even small amounts can make a big difference over time.

-

Interest Rate Reduction: Explore options to reduce your interest rate, such as balance transfers or contacting your credit card issuer to request a lower rate.

-

Financial Counseling: Seek professional financial advice if you're struggling to manage your credit card debt.

Final Conclusion: Wrapping Up with Lasting Insights

The minimum payment on your credit card statement is a critical figure that shouldn't be overlooked. While it seemingly offers a small, manageable payment, consistently relying on it can lead to a crippling cycle of debt. Understanding its calculation, the impact of interest, and employing responsible payment strategies are essential for maintaining good credit and securing your financial future. Take control of your credit card debt today by paying more than the minimum and working towards a debt-free future.

Latest Posts

Latest Posts

-

How To Apply For Navy Federal Credit Union

Apr 06, 2025

-

Which Credit Cards Give The Highest Credit Limits

Apr 06, 2025

-

What Card Has The Highest Credit Limit

Apr 06, 2025

-

What Is The Highest Credit Limit For Capital One Gold Mastercard

Apr 06, 2025

-

What Is The Highest Credit Limit You Can Get On A Credit Card

Apr 06, 2025

Related Post

Thank you for visiting our website which covers about What Does The Minimum Payment Amount On A Credit Card Statement Indicate . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.