How To Calculate Minimum Monthly Payment On A Line Of Credit

adminse

Apr 05, 2025 · 8 min read

Table of Contents

Decoding the Minimum Payment: A Comprehensive Guide to Line of Credit Calculations

What if understanding your line of credit minimum payment could save you thousands of dollars in interest? Mastering this calculation is key to responsible credit management and financial freedom.

Editor’s Note: This article provides a detailed explanation of how to calculate minimum monthly payments on a line of credit, offering practical strategies for managing debt effectively. Updated [Date of Publication], this guide uses real-world examples and addresses common misconceptions.

Why Understanding Minimum Payments Matters:

A line of credit (LOC) offers flexible borrowing, but its convenience can be deceptive. Failing to understand minimum payment calculations can lead to accumulating high interest charges, prolonged repayment periods, and potential damage to your credit score. Knowing how to calculate and manage these payments empowers you to control your debt and make informed financial decisions. Understanding these calculations impacts your personal finances, your creditworthiness, and your overall long-term financial health. This knowledge is crucial for budgeting, debt management, and financial planning.

Overview: What This Article Covers:

This comprehensive guide breaks down the complexities of line of credit minimum payment calculations. We'll explore various methods, address common scenarios, and provide practical tips to help you effectively manage your LOC debt. We will examine the different factors influencing minimum payments, explore the implications of only making the minimum payment, and offer strategies for accelerating debt repayment.

The Research and Effort Behind the Insights:

This article draws upon established financial principles, widely accepted lending practices, and real-world examples. The information presented is intended to be comprehensive and accessible, supporting informed decision-making for managing line of credit debt. We have referenced reputable sources to ensure accuracy and clarity.

Key Takeaways:

- Understanding the basics of interest calculation: Learn how interest accrues on a line of credit.

- Calculating minimum payments based on different methods: Explore various approaches used by lenders.

- Factors influencing minimum payments: Discover what determines your minimum payment amount.

- The impact of making only minimum payments: Understand the long-term financial consequences.

- Strategies for faster debt repayment: Learn how to reduce your debt faster and save on interest.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding minimum payments, let's delve into the specifics of calculating them.

Exploring the Key Aspects of Line of Credit Minimum Payment Calculations:

Several factors influence the calculation of your minimum payment on a line of credit. While the exact formula varies between lenders, understanding the underlying principles remains crucial.

1. Interest Calculation:

Most lines of credit utilize a method called simple interest. This means interest is calculated daily on your outstanding balance. The daily interest rate is determined by dividing the annual percentage rate (APR) by 365 (or 360, depending on the lender).

- Formula: Daily Interest = (APR / 365) * Outstanding Balance

The accumulated interest for a given month is then added to your outstanding principal balance to determine your new balance. This new balance is used in the next calculation.

Example:

Let's say you have an outstanding balance of $5,000 with a 12% APR.

- Daily interest rate: 12% / 365 = 0.0329%

- Daily interest on $5,000: 0.000329 * $5,000 = $1.645

Over 30 days, the accumulated interest would be approximately $1.645 * 30 = $49.35. Your new balance would then be $5,049.35.

2. Minimum Payment Calculation Methods:

Lenders utilize different methods to determine the minimum payment:

-

Percentage of Outstanding Balance: This is a common method where the minimum payment is a fixed percentage (e.g., 1% or 2%) of your outstanding balance. Higher balances will, therefore, require larger minimum payments.

-

Fixed Minimum Payment: Some lenders set a fixed minimum payment amount regardless of your outstanding balance. This approach can be beneficial for borrowers with consistently low balances but can lead to slow repayment for higher balances.

-

Combination Method: Some lenders use a combination of both methods. A minimum payment might be calculated as a percentage of the balance, but with a specified minimum dollar amount (e.g., at least $25, regardless of the percentage calculation).

-

Amortization Schedule: While not typically used for calculating the minimum payment directly, an amortization schedule determines the payment required to pay off the entire balance within a set timeframe. Your minimum payment may be a portion or adjustment of the payment required on the amortization schedule.

3. Factors Affecting Minimum Payments:

Several factors can affect your minimum monthly payment:

-

APR (Annual Percentage Rate): A higher APR means more interest accrues daily, potentially leading to a higher minimum payment (though often the minimum payment is a flat percentage, regardless of the interest rate).

-

Outstanding Balance: A higher balance usually requires a larger minimum payment, especially when calculated as a percentage of the outstanding balance.

-

Credit Limit: The available credit on your LOC influences your payment strategy, allowing you to borrow and repay strategically, but this doesn’t directly change the minimum payment calculation.

-

Payment History: Consistently making timely payments can improve your credit score, but it rarely has an effect on your minimum monthly payment calculation.

4. The Impact of Making Only Minimum Payments:

Making only the minimum payment prolongs the repayment period and increases the total interest paid over the life of the loan. A significant portion of your payment each month goes towards interest, leaving a small amount to reduce the principal balance. This is often referred to as the “debt trap” – a cycle where you make payments but don't reduce the principal balance significantly, and thus the loan lasts for much longer.

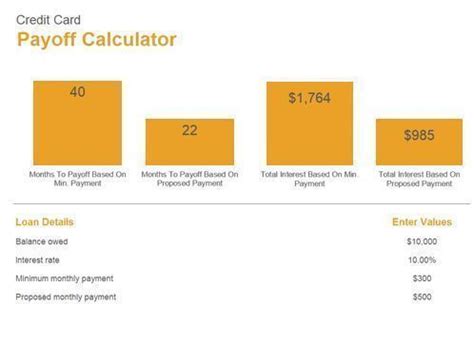

Example:

Let's assume a $10,000 balance with a 15% APR and a minimum payment of 2% of the outstanding balance. Paying only the minimum payment could result in paying significantly more in interest over time compared to a higher payment that pays down the principal quicker. A financial calculator or spreadsheet can help demonstrate this clearly.

Exploring the Connection Between Interest Rates and Minimum Payments:

The interest rate on your line of credit plays a vital role in determining the minimum payment amount, though most minimum payments are set as flat percentage amounts regardless of the interest rate. A higher interest rate means that a larger portion of your minimum payment will be allocated towards interest, leaving less to reduce the principal balance. This directly impacts the duration of your repayment and the total interest paid.

Key Factors to Consider:

-

Roles and Real-World Examples: Consider the impact of a higher interest rate. If you have a 20% APR versus a 10% APR and a 2% minimum payment, both will have the same minimum dollar amount, but the interest portion will be greater on the 20% rate, leaving even less to be paid to your principal balance.

-

Risks and Mitigations: The risk is being trapped in a cycle of minimum payments. Mitigation strategies include increasing payments, researching balance transfer options, or considering debt consolidation.

-

Impact and Implications: The long-term impact of only making minimum payments can include increased interest costs, extended repayment periods, and negative impacts on your credit score (due to it taking so long to repay).

Conclusion: Reinforcing the Connection:

The relationship between interest rates and minimum payments is crucial. While the minimum payment calculation itself might not directly utilize the APR in its equation, the interest rate profoundly affects the allocation of that minimum payment, with higher rates allocating a larger portion to interest and less to reducing the principal. This directly impacts your ability to pay off the debt efficiently.

Further Analysis: Examining Interest Calculation in Greater Detail:

Lenders typically use daily interest calculations. This means that interest charges are calculated daily on the outstanding balance and added to your account balance, leading to compound interest over time. The more you owe, the more interest you accrue daily. This demonstrates the importance of paying down your balance as quickly as possible.

FAQ Section: Answering Common Questions About Line of Credit Minimum Payments:

-

Q: What happens if I miss a minimum payment? A: You'll likely incur late fees and your credit score will be negatively affected. Your interest rate may also increase, potentially raising future minimum payments.

-

Q: Can I negotiate my minimum payment with my lender? A: It's unlikely that a lender will negotiate a lower minimum payment, but you can explore options for increasing your payments to accelerate debt repayment.

-

Q: How can I determine my minimum payment amount? A: Check your monthly statement or contact your lender directly. The statement should clearly indicate the minimum payment due.

-

Q: What if my minimum payment calculation seems incorrect? A: Contact your lender immediately to verify the calculation. There could be an error in the calculation, or there might be other charges affecting your balance.

Practical Tips: Maximizing the Benefits of Line of Credit Management:

-

Understand the Basics: Fully understand how interest is calculated and how your minimum payment is determined.

-

Budget Strategically: Integrate your minimum payment into your monthly budget and aim to pay more than the minimum whenever possible.

-

Monitor Your Account Regularly: Track your outstanding balance and interest charges to ensure accuracy and catch any potential errors.

-

Explore Repayment Options: Consider strategies like debt consolidation or balance transfers to potentially lower your interest rate and reduce your minimum payment.

-

Contact Your Lender: If you face financial difficulties, contact your lender immediately to discuss potential solutions. Many lenders offer hardship programs or payment deferrals.

Final Conclusion: Wrapping Up with Lasting Insights:

Calculating and understanding your minimum monthly payment on a line of credit is fundamental to responsible debt management. While the formula may vary, the underlying principles remain consistent: higher balances, higher APRs (though not usually directly used in the formula), and payment patterns affect your overall cost and repayment timeline. By proactively managing your LOC and paying more than the minimum whenever possible, you can save substantially on interest and achieve financial freedom faster. Regular monitoring and understanding the potential long-term impact of paying only the minimum is key to successful debt management and financial well-being.

Latest Posts

Latest Posts

-

What Is An Acceptable Credit Utilization Ratio

Apr 07, 2025

-

What Is A Good Amount Of Credit Utilization

Apr 07, 2025

-

What Percent Should My Credit Utilization Be

Apr 07, 2025

-

What Percentage Should I Keep My Credit Card Usage Under

Apr 07, 2025

-

What Percentage Should I Keep My Credit Card Usage At

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate Minimum Monthly Payment On A Line Of Credit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.