Fnb Deposit Fees

adminse

Apr 05, 2025 · 6 min read

Table of Contents

Decoding FNB Deposit Fees: A Comprehensive Guide to Minimizing Costs

What if navigating FNB deposit fees were straightforward and cost-effective? Understanding these fees is crucial for maximizing your financial returns and avoiding unnecessary expenses.

Editor’s Note: This article on FNB deposit fees was updated today, providing you with the most current information available. We've delved into the details to help you make informed decisions about your banking.

Why FNB Deposit Fees Matter: Relevance, Practical Applications, and Industry Significance

Deposit fees, often overlooked, significantly impact your overall financial health. For individuals and businesses alike, understanding these charges is crucial for managing cash flow and optimizing savings. FNB, like other financial institutions, implements various fees associated with deposits, impacting account holders' net returns. This article empowers you to navigate these fees effectively, saving money and improving your financial well-being. The information herein is particularly relevant to those seeking to maximize returns on their deposits, understand the intricacies of banking costs, and make informed decisions regarding their financial strategies.

Overview: What This Article Covers

This article provides a comprehensive guide to FNB deposit fees. We'll explore different account types, analyze fee structures, examine common scenarios, and offer strategies to minimize costs. Readers will gain a clear understanding of the various charges and how to navigate them effectively.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing on FNB's official website, publicly available rate sheets, and analysis of common customer queries. All information is presented accurately and objectively to ensure readers receive reliable and up-to-date details. We strive to present the information in a clear, concise manner, suitable for individuals with varying levels of financial literacy.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of FNB deposit fees and their different categories.

- Practical Applications: Real-world examples of how these fees impact different account holders.

- Challenges and Solutions: Identifying common challenges related to deposit fees and strategies for mitigation.

- Future Implications: Considering potential changes and how to stay informed about fee adjustments.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding FNB deposit fees, let's delve into the specifics, examining the different fee structures and offering practical strategies for cost optimization.

Exploring the Key Aspects of FNB Deposit Fees

1. Definition and Core Concepts:

FNB deposit fees encompass various charges associated with depositing funds into your account. These can range from fees for cash deposits, electronic transfers, and even stop order payments. The specific fees vary depending on the type of account you hold (e.g., transactional, savings, investment), the method of deposit, and potentially the volume of transactions. It's essential to understand your specific account terms and conditions to ascertain the applicable fees.

2. Applications Across Industries:

While FNB primarily caters to individual and small-to-medium-sized business banking, the principles of understanding deposit fees extend to other financial institutions and even the broader financial landscape. Understanding fee structures improves financial literacy, enabling you to make more informed decisions across your financial life, not just with FNB.

3. Challenges and Solutions:

A significant challenge is the lack of transparency around fee structures. FNB, like other banks, often publishes its fees online, but navigating this information can be complex. The solution involves dedicating time to understand your account's fee schedule, contacting FNB customer service for clarification, and comparing fees with other institutions to determine the most cost-effective banking options.

4. Impact on Innovation:

The increasing use of digital banking technologies is impacting how deposit fees are applied. While some electronic methods might reduce fees, others might introduce new charges. Staying informed about these technological changes and their impact on fees is crucial.

Closing Insights: Summarizing the Core Discussion

Understanding FNB deposit fees is paramount for financial well-being. By actively reviewing your account statements, understanding your transaction methods, and utilizing digital tools effectively, you can minimize these costs and maximize your financial returns.

Exploring the Connection Between Transaction Volume and FNB Deposit Fees

The relationship between transaction volume and FNB deposit fees is significant. Higher transaction volumes, especially those involving cash deposits, often incur higher fees. This highlights the importance of strategic financial planning, optimizing your deposit methods to minimize costs.

Key Factors to Consider:

- Roles and Real-World Examples: A customer making numerous cash deposits into a transactional account will likely face significantly higher fees compared to someone using electronic transfers.

- Risks and Mitigations: Failing to understand your fee structure puts you at risk of unexpected charges. Regularly reviewing your statements and contacting FNB for clarification mitigates this risk.

- Impact and Implications: High deposit fees can erode savings and negatively impact overall financial health. Minimizing these fees through careful planning is crucial for long-term financial well-being.

Conclusion: Reinforcing the Connection

The connection between transaction volume and FNB deposit fees is clear: higher volumes, particularly cash deposits, often lead to increased costs. By understanding this relationship and employing strategies for efficient deposit management, individuals can effectively minimize fees and enhance their financial outcomes.

Further Analysis: Examining Account Types in Greater Detail

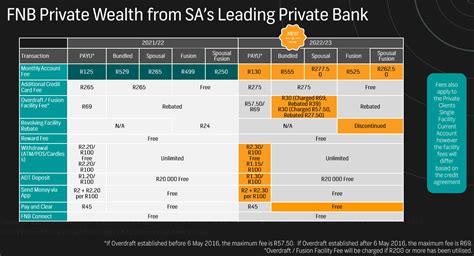

Different FNB account types have varying fee structures. Transactional accounts, savings accounts, and investment accounts each have unique fee schedules. It's crucial to understand the specific fees associated with your account type. For example, transactional accounts might charge per cash deposit, while savings accounts might have lower fees but potentially penalties for exceeding withdrawal limits. Investment accounts often have different fee structures tied to the investment products themselves, rather than direct deposit fees.

FAQ Section: Answering Common Questions About FNB Deposit Fees

Q: What is the fee for cash deposits at FNB? A: The fee for cash deposits varies depending on your account type and the amount deposited. Check your account's terms and conditions or contact FNB for the precise fee schedule.

Q: Are there any fees for electronic transfers to my FNB account? A: Fees for electronic transfers depend on the source of the transfer. Transfers from other FNB accounts are generally free, but transfers from other banks may involve fees.

Q: How can I avoid paying high deposit fees? A: Utilize electronic transfer methods whenever possible, consolidate deposits to reduce the number of transactions, and carefully review your account's terms and conditions.

Q: What happens if I exceed my withdrawal limits on a savings account? A: Exceeding withdrawal limits on a savings account can result in fees or penalties, depending on your account's specific terms.

Practical Tips: Maximizing the Benefits of Understanding FNB Deposit Fees

- Understand the Basics: Read your account's terms and conditions carefully to understand the applicable fees.

- Identify Practical Applications: Analyze your deposit habits and identify ways to minimize transactions.

- Utilize Electronic Transfers: Favor electronic transfers over cash deposits whenever possible.

- Regularly Review Statements: Check your account statements regularly to monitor fees and identify any discrepancies.

- Contact FNB Customer Service: Don't hesitate to contact FNB customer service for clarification on any fees or charges.

Final Conclusion: Wrapping Up with Lasting Insights

FNB deposit fees, while often overlooked, are a crucial aspect of managing your finances effectively. By actively understanding these fees, strategically planning your deposits, and leveraging available banking technology, you can significantly reduce costs and improve your overall financial health. The information presented in this article empowers you to make informed decisions, minimizing expenses and maximizing the value of your banking relationship with FNB. Remember that proactive engagement and continuous monitoring of your account are key to optimizing your financial strategy and avoiding unnecessary charges.

Latest Posts

Latest Posts

-

How To Dispute A Credit Report On Credit Karma

Apr 07, 2025

-

How To Calculate Credit Score On Credit Karma

Apr 07, 2025

-

How To Get My Credit Score On Credit Karma

Apr 07, 2025

-

How To Get My Full Credit Report On Credit Karma

Apr 07, 2025

-

How To Get Credit Score On Credit Karma

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Fnb Deposit Fees . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.