Do You Need A Best Buy Credit Card To Do Monthly Payments

adminse

Apr 05, 2025 · 7 min read

Table of Contents

Do You Need a Best Buy Credit Card to Make Monthly Payments? Unlocking Payment Flexibility at Best Buy

Do you really need a Best Buy credit card to spread out your payments? The short answer is: absolutely not!

Editor’s Note: This article provides up-to-date information on payment options available at Best Buy, clarifying common misconceptions about the necessity of their store credit card for monthly installments. Updated October 26, 2023.

Why Payment Flexibility Matters: In today's economy, managing large purchases requires careful planning. Whether you're upgrading your home theater system, investing in new appliances, or buying essential electronics, the ability to break down payments into manageable monthly installments is crucial for many consumers. Best Buy, understanding this need, offers various financing options beyond their branded credit card.

Overview: What This Article Covers

This comprehensive guide explores the various payment methods available at Best Buy, focusing on the common misconception that their credit card is the only way to make monthly payments. We'll delve into the specifics of Best Buy's financing options, compare them to alternative payment methods, and address frequently asked questions. You'll gain a clear understanding of your choices and choose the best payment plan for your financial situation.

The Research and Effort Behind the Insights

This article is the result of meticulous research, incorporating information directly from Best Buy's official website, terms and conditions, and widely available consumer reviews. We've analyzed their payment options to ensure accuracy and provide unbiased information, empowering you to make informed decisions.

Key Takeaways:

- Best Buy Credit Card is NOT mandatory for monthly payments: While the Best Buy credit card offers its own financing programs, it's not a requirement to make monthly payments on purchases.

- Alternative financing options exist: Best Buy partners with third-party lenders offering various financing programs, providing flexibility to consumers.

- Other payment methods: Besides financing, Best Buy accepts various payment methods, including debit cards, credit cards (from any issuer), and even PayPal.

Smooth Transition to the Core Discussion:

Now that we've established the core truth – you don't need the Best Buy credit card for monthly payments – let's explore the various options available to you.

Exploring the Key Aspects of Best Buy Payment Options

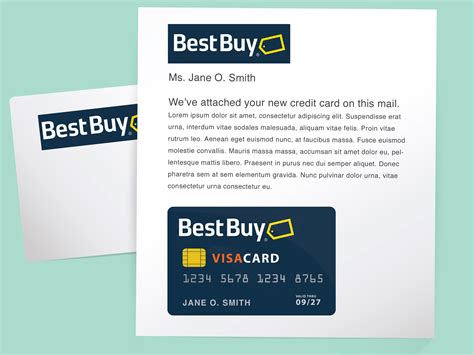

1. Best Buy Credit Card:

While not mandatory, the Best Buy credit card offers its own advantages, primarily revolving around its financing programs and potential rewards. These programs frequently offer promotional 0% APR financing for a limited period, allowing you to pay off larger purchases interest-free if you meet the payment schedule. However, it’s crucial to understand the terms and conditions carefully, as interest rates can be high after the promotional period ends. Late payments can significantly impact your credit score.

2. Third-Party Financing Programs:

Best Buy frequently partners with various financial institutions to offer alternative financing options. These programs typically allow you to apply for a loan directly through Best Buy's website or in-store, often with flexible repayment terms and interest rates that vary depending on your creditworthiness and the loan amount. This offers more flexibility if you don't qualify for the Best Buy credit card or prefer not to open another credit account.

3. Layaway Plans:

For consumers who prefer to pay for their purchase in full but over time, Best Buy may offer layaway plans, especially during holiday seasons. This allows you to secure an item and make regular payments until it's fully paid off, at which point you can take possession of your purchase. Check Best Buy's website or contact your local store for current availability and terms.

4. Traditional Payment Methods:

Besides financing options, Best Buy accepts various payment methods including:

- Debit Cards: You can use your debit card to make a single payment for your purchase.

- Credit Cards (from any issuer): You can use any credit card, not just the Best Buy card, to make a single purchase. However, note that your credit card's interest rate will apply if you don't pay the balance in full.

- PayPal: Best Buy offers a convenient payment option through PayPal, allowing you to use your PayPal balance or link a credit or debit card for payment.

- Best Buy Gift Cards: You can use Best Buy gift cards to purchase items, either fully or partially.

Closing Insights: Summarizing the Core Discussion

The key takeaway here is choice. Best Buy understands that consumers have diverse financial situations and preferences. While the Best Buy credit card offers one route to manageable payments, it's far from the only one. Consumers have access to various financing programs from third-party lenders, layaway plans (when available), and standard payment options using debit or credit cards and PayPal. Choosing the right option depends on your individual financial goals and risk tolerance.

Exploring the Connection Between Credit Score and Payment Options

Your credit score plays a significant role in determining the type of financing available to you at Best Buy. A higher credit score generally leads to more favorable terms, lower interest rates, and potentially higher credit limits. Conversely, a lower credit score may limit your access to certain financing options or result in higher interest rates. Therefore, improving your credit score before making a large purchase can significantly impact your payment options and overall cost.

Key Factors to Consider:

- Roles and Real-World Examples: A consumer with excellent credit could secure a 0% APR financing option for 12 months through a Best Buy credit card or a third-party lender, significantly reducing the overall cost. A consumer with fair credit may only qualify for a higher-interest loan with shorter repayment terms.

- Risks and Mitigations: High-interest rates on credit cards or loans can lead to accumulating debt quickly. Always read the fine print carefully and only borrow what you can comfortably afford to repay. Creating a realistic budget and sticking to a repayment plan is crucial.

- Impact and Implications: The interest rate significantly impacts the total cost of your purchase. A lower interest rate can save you hundreds or even thousands of dollars over the life of the loan. Defaulting on payments can severely damage your credit score, impacting your ability to access credit in the future.

Conclusion: Reinforcing the Connection

The relationship between your credit score and available payment options at Best Buy is undeniable. Understanding your creditworthiness empowers you to make informed decisions about financing and choose the most cost-effective payment plan.

Further Analysis: Examining Credit Score Improvement in Greater Detail

Improving your credit score takes time and effort but is achievable. Key strategies include:

- Paying bills on time: This is the single most impactful factor in your credit score. Consistent on-time payments demonstrate responsible credit management.

- Keeping credit utilization low: Aim to keep your credit card balances below 30% of your total credit limit.

- Maintaining a diverse credit mix: Having a variety of credit accounts (credit cards, loans) can positively impact your score, but only if managed responsibly.

- Monitoring your credit report: Regularly check your credit report for errors and inconsistencies. Dispute any inaccurate information.

FAQ Section: Answering Common Questions About Best Buy Payments

- What is the best payment method at Best Buy? The best payment method depends on your individual circumstances and financial situation. Consider your credit score, the purchase price, and your ability to make timely payments.

- Can I return an item if I financed it through Best Buy? Return policies vary depending on the financing option used. Check Best Buy's return policy and the terms of your financing agreement.

- What happens if I miss a payment on my Best Buy credit card? Missing payments will result in late fees, increased interest rates, and a negative impact on your credit score.

- Can I use a third-party financing option for smaller purchases? This depends on the specific terms and conditions of the financing program. Some lenders may have minimum purchase amounts.

Practical Tips: Maximizing the Benefits of Best Buy Payment Options

- Compare financing options: Carefully compare interest rates, repayment terms, and fees before choosing a financing plan.

- Read the fine print: Always read the terms and conditions of any financing agreement before signing.

- Budget carefully: Create a budget to ensure you can comfortably afford the monthly payments.

- Pay on time: Make timely payments to avoid late fees and damage to your credit score.

Final Conclusion: Wrapping Up with Lasting Insights

Best Buy offers a variety of payment methods, allowing consumers flexibility in how they manage large purchases. While the Best Buy credit card is a viable option, it’s not a necessity for making monthly payments. Consumers should carefully evaluate their financial situation, credit score, and the terms of available financing options to choose the payment method that best suits their needs. Remember, responsible financial planning is key to maximizing the benefits and avoiding potential pitfalls.

Latest Posts

Latest Posts

-

What Percentage Should I Keep My Credit Card Usage Under

Apr 07, 2025

-

What Percentage Should I Keep My Credit Card Usage At

Apr 07, 2025

-

What Percent Should You Keep Your Credit Utilization

Apr 07, 2025

-

What Percentage Should You Keep Your Credit Utilization

Apr 07, 2025

-

What Percentage Should You Keep Your Credit Utilization Below

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Do You Need A Best Buy Credit Card To Do Monthly Payments . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.